The West has been coherent in response to Russia, but faultlines are emerging between the US & other Western-oriented countries. 2022 may be peak West.

Read MoreThe experiences of small economy hubs – from Dubai to Ireland, Hong Kong, Singapore, & Switzerland – highlight the impact of a changing global economy

Read MoreBeyond the stormy economic forecasts in the IMF’s latest World Economic Outlook, the data also capture structural changes underway in the global system

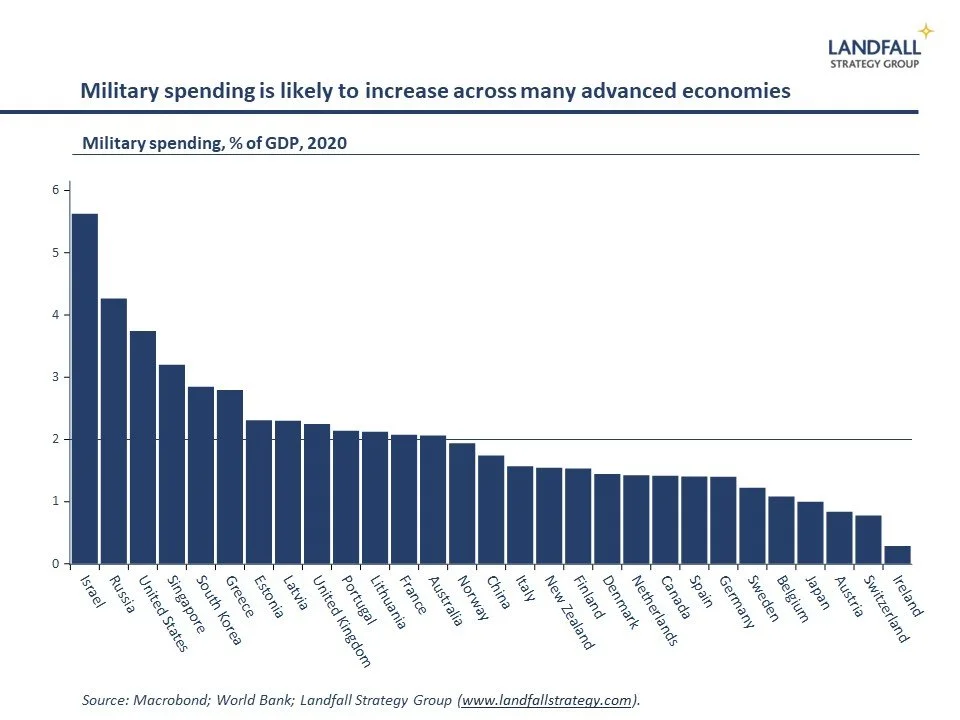

Read MoreExpect to see the state expand its role, on the back of disruptive changes in the global economic & political environment

Read MoreMy travels in Europe, the Middle East, & North Africa this week showed variation in economic outlook, as well as in positioning for a new global regime

Read MoreA gap is emerging between government & firm responses to geopolitical tensions: firms are moving more slowly, creating risks

Read MoreEconomic & political risks are rising around the world. But governments, firms, & investors should be looking to new opportunities as well as managing risks.

Read MoreMy recent travels to New Zealand & Singapore highlighted more similarities (concerns on geopolitics, inflation) than differences between Asia & Europe

Read MoreDespite the focus on big powers and mega firms, scale is not everything in the global economy. Smaller, agile firms & countries often have an edge.

Read MoreEconomies with high core inflation tend to have the tightest labour markets; monetary policy is not enough to reduce inflation

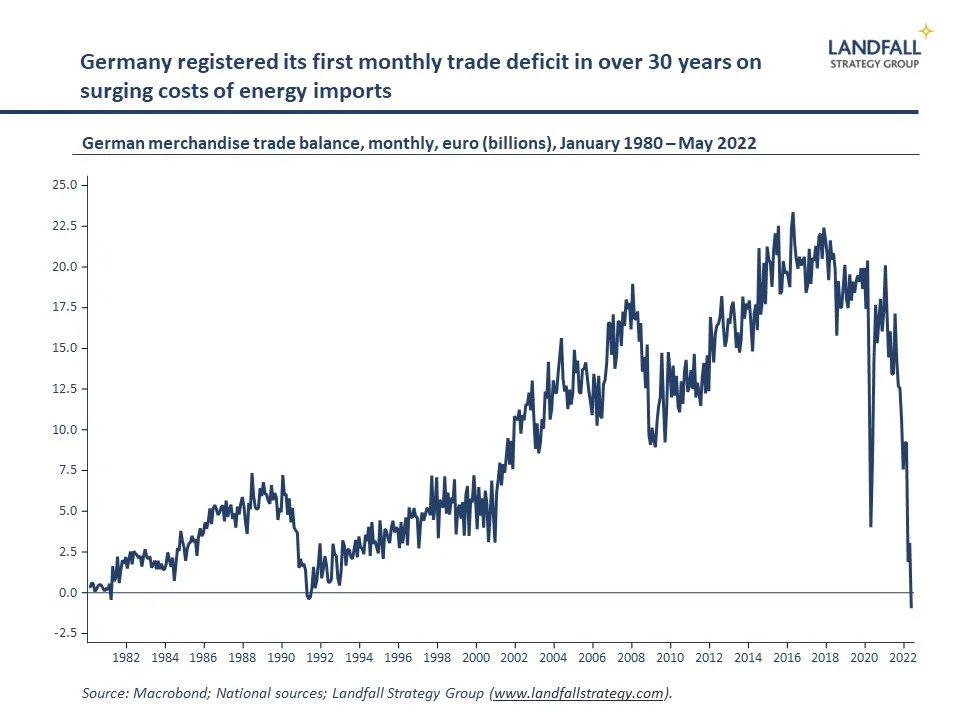

Read MoreThe war of attrition between Russia and Ukraine is as much economic as military; and the economic costs are growing

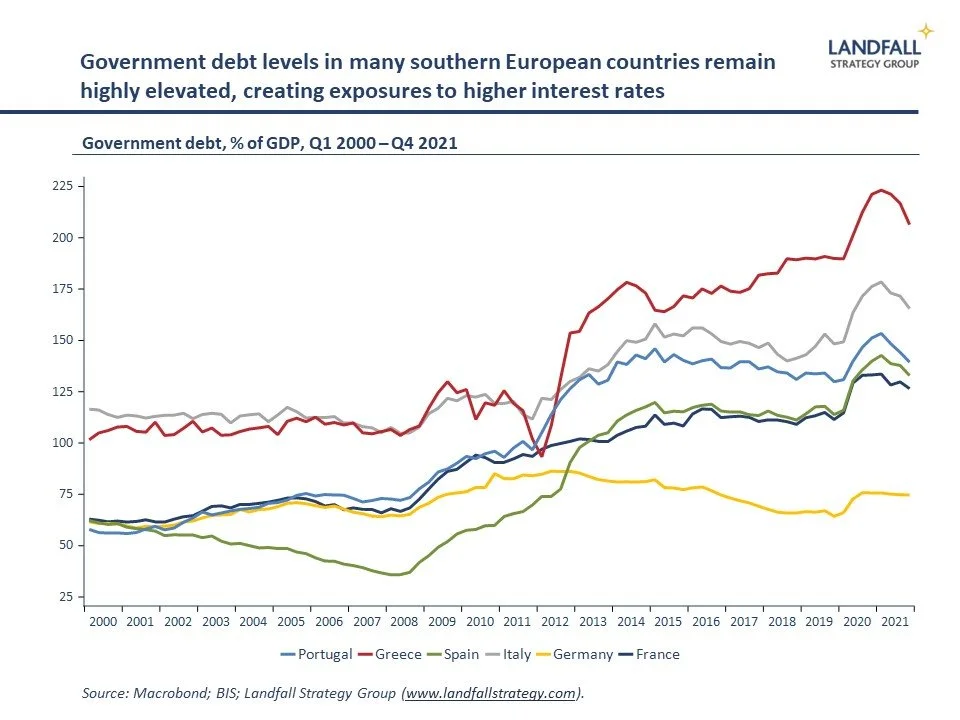

Read MoreThe G7, NATO, & ECB meetings this week provide a sense of the scale & scope of current global challenges, and some of the emerging responses

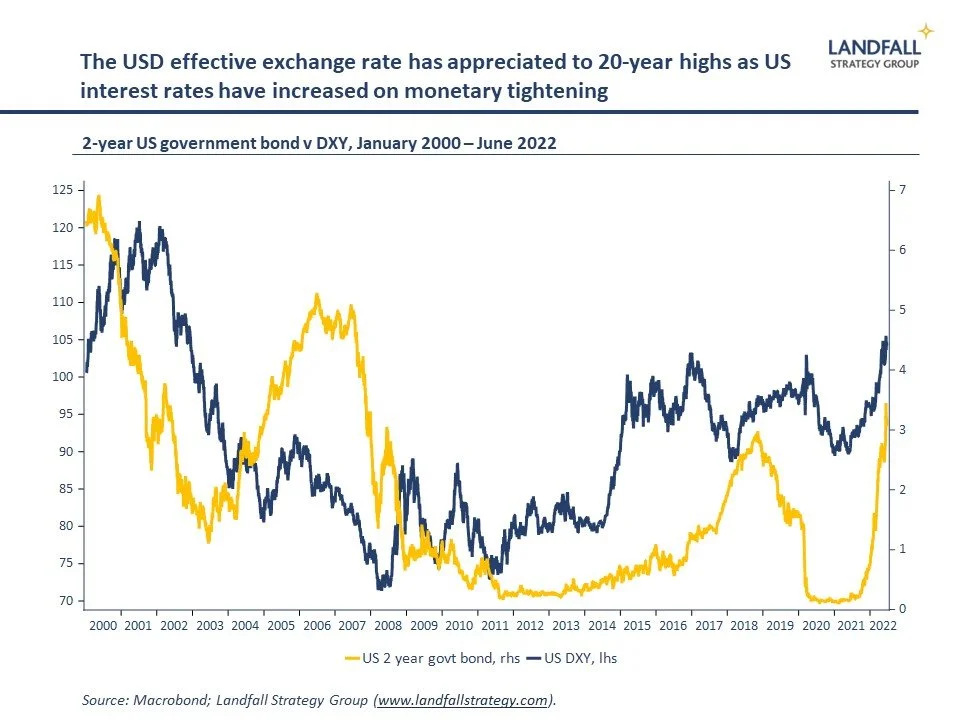

Read MoreTight US monetary policy in response to surging inflation is creating issues around the global economy, with potentially lasting economic & political consequences

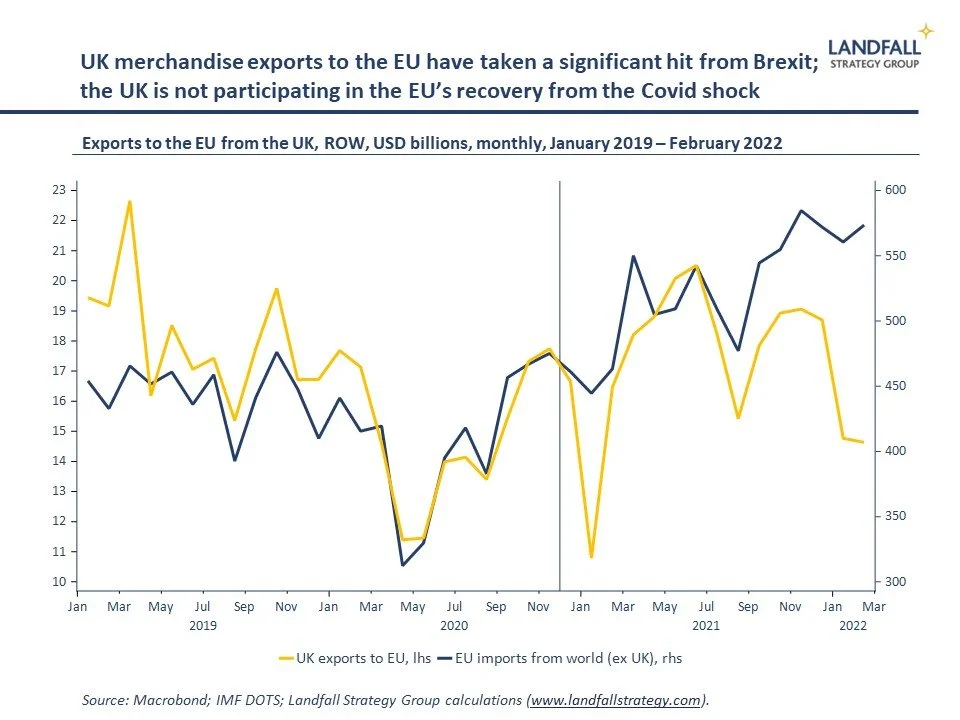

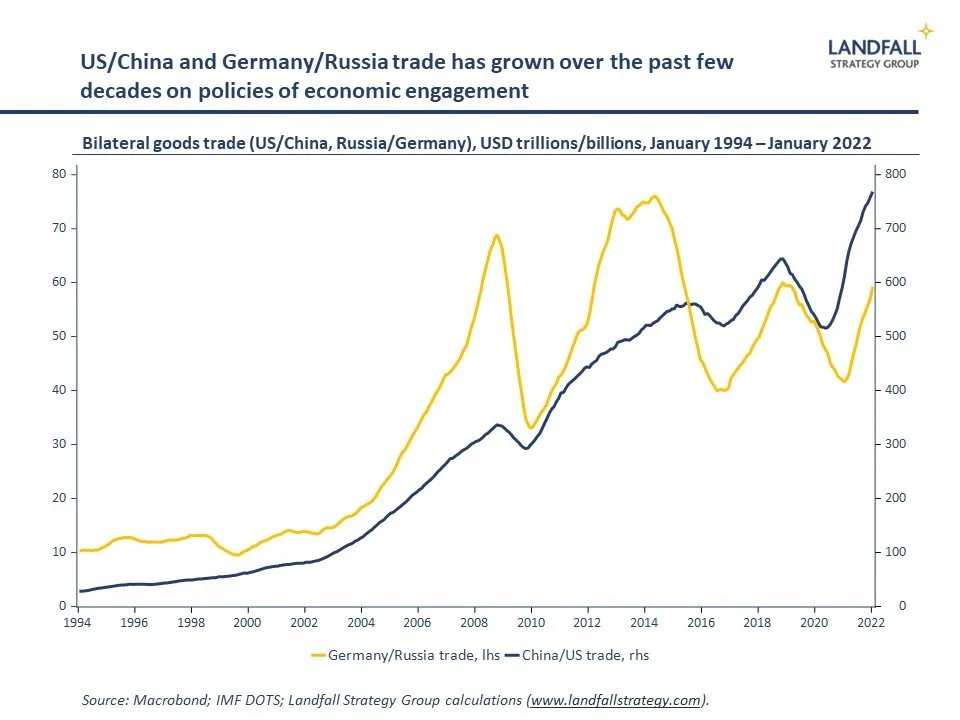

Read MoreSix years on from the Brexit and Trump votes, the emerging model of globalisation means that America First is likely to be enduring than hard Brexit

Read MoreThe pandemic coupled with geopolitical tensions, net zero, & technology will structurally change the economic geography of globalisation.

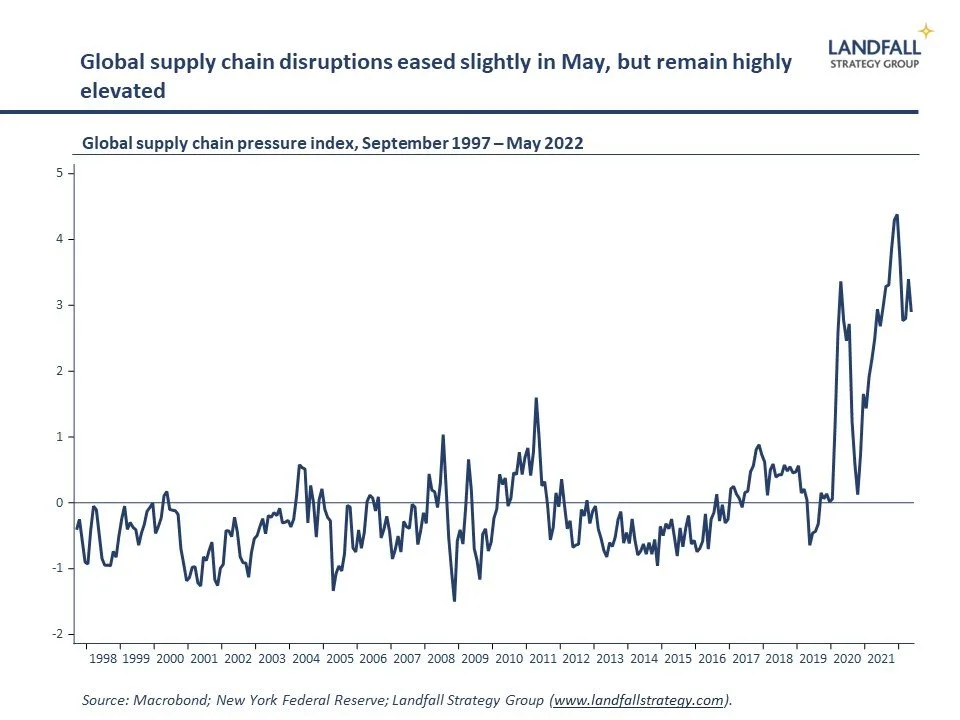

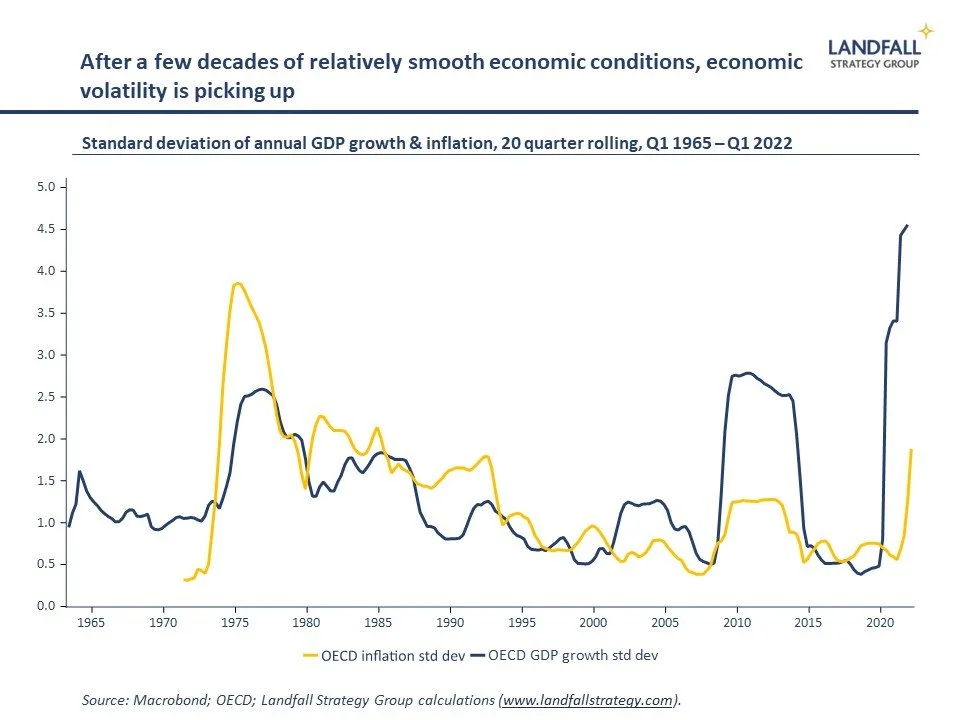

Read MoreEconomic & political volatility is rising as a new global regime emerges. Firms & governments need to position for sustained turbulence.

Read MoreGeopolitics trumped globalisation at Davos this week. But there are risks to be managed as globalisation becomes more political

Read MoreThe good times of the past 30 years have created economic & political exposures for firms & countries in a changing world

Read MoreThe economic and political aftershocks from Russia’s invasion continued this week, from Europe to Asia. Deep structural change is underway.

Read MoreDomestic political risks with global economic & geopolitical consequences loom large around the world from China to the US. Brace for shocks.

Read More